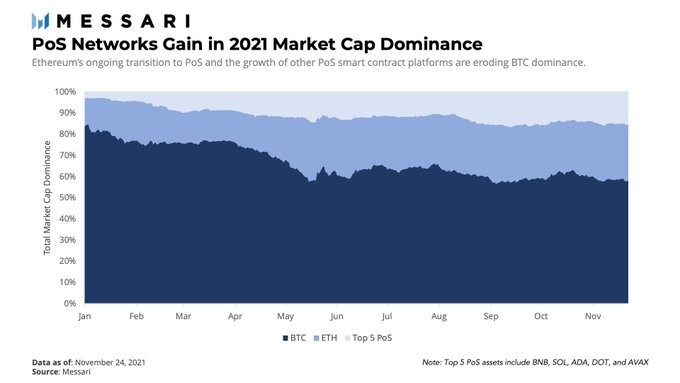

The proof of stake (PoS) consensus mechanism has gained steam in 2021 because it is more environmentally friendly and cost-effective compared to the proof of work (PoW) framework used in networks like Bitcoin (BTC).

Therefore, this trend change is providing monetary opportunities for staking-as-a-service providers. Chase Devens, a research analyst at Messari, confirmed:

“PoS is quickly replacing PoW as the dominant consensus engine for modern blockchains. This opens the door for staking-as-a-service (STaaS) providers to build billion $ businesses to support the security of PoS networks.”

Investment writer, Tascha, echoed these sentiments and said:

“The majority of PoS blockchain citizens are already getting “universal basic capital income” via staking rewards.”

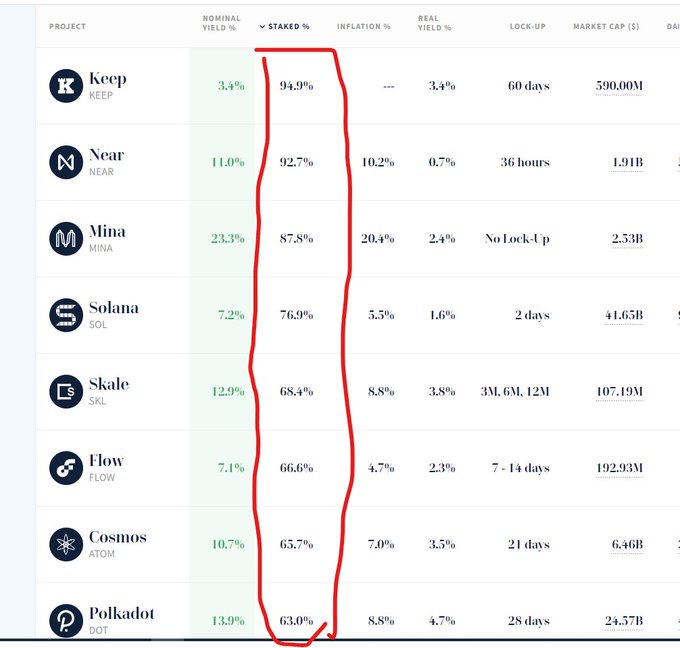

Solana recently emerged as the most staked crypto with a value of $78.49, according to a study by crypto insight provider Staking Rewards.

Staking entails locking up crypto assets for a certain period of time to assist a blockchain network in functions like the confirmation of transactions. In return, investors earn interest or rewards.

Networks using the PoS framework like Solana, Polkadot, and Cardano are decentralized and can interact with smart contracts utilized in the booming decentralized finance (DeFi) and non-fungible token (NFT) sectors.

With the proof of stake algorithm, block validation is dependent on the number of coins staked or held. However, this is not the case with the PoW framework because validation is based on solving a cryptographic puzzle, which involves mathematical calculations.

Despite Ethereum using the proof of stake consensus mechanism, it seeks to transit to the proof of work system through the ETH 2.0 deposit contract, also known as the Beacon Chain, launched in December 2020. Therefore, Ethereum 2.0 is expected to improve the network’s scalability through sharding.

Image source: Shutterstock

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Stellar

Stellar  Avalanche

Avalanche  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  WETH

WETH  Sui

Sui  Pepe

Pepe  NEAR Protocol

NEAR Protocol  LEO Token

LEO Token  Litecoin

Litecoin  Aptos

Aptos  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Hedera

Hedera  Internet Computer

Internet Computer  USDS

USDS  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Ethereum Classic

Ethereum Classic  Render

Render  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Ethena USDe

Ethena USDe  Bittensor

Bittensor  Bonk

Bonk  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  Arbitrum

Arbitrum  Filecoin

Filecoin  Cosmos Hub

Cosmos Hub  Celestia

Celestia  MANTRA

MANTRA  OKB

OKB