Ethereum users recently got a sigh of relief as the median fees dropped to $5.50 per transaction from highs of $34.18 last month.

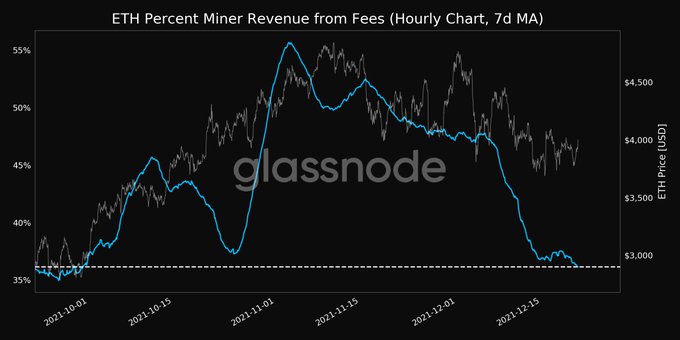

This has in turn made the percentage of miner revenue from fees on the ETH network reach a monthly low of 36.145%, according to market insight provider Glassnode.

High gas fees have grappled the Ethereum network throughout 2021, given that it has increased by ten times since the fourth quarter of last year.

Data analytic firm IntoTheBlock acknowledged that high demand was driving the fees upwards, and despite this, users were still willing to pay to utilize the ETH network.

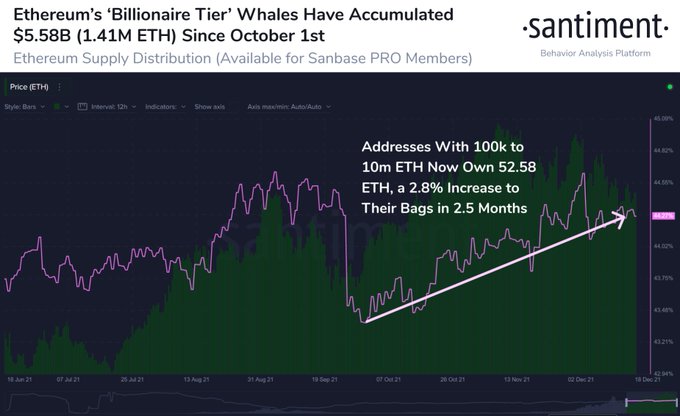

Meanwhile, whale addresses on the Ethereum network have been on an accumulation spree. Crypto insight provider Santiment confirmed:

“Billionaire addresses with 100k to 10m ETH have accumulated $5.58B of ETH (1.41M coins) since Oct 1st, adding 2.8% more to their bags in these past ~2.5 months.”

Holding is a favoured strategy in the crypto market because coins are stored for future purposes other than speculation.

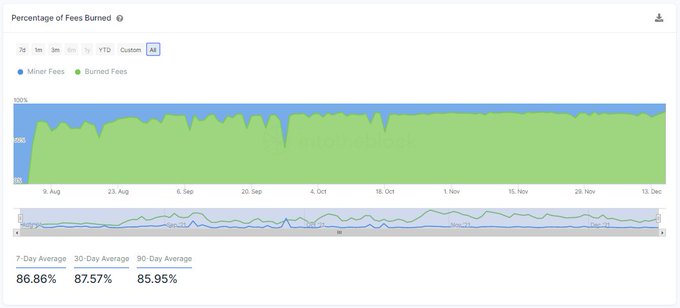

On the other hand, economic activities happening on the Ethereum network have been instrumental to holders. IntoTheBlock stated:

“Ether holders have regardless benefited from the economic activity taking place on Ethereum. Since the implementation of EIP-1559, a high percentage of the ETH paid in fees (85% on average) is burnt, effectively removing this supply from inflation.”

Furthermore, the high transaction volume experienced on the ETH network is making the second-largest cryptocurrency an engine of economic activity. For instance, the total volume processed between Ethereum and stablecoins has tripled since the fourth quarter of 2020.

Therefore, various use cases have been driving transaction volume up, given that Ethereum is one of the sought-after networks in the booming decentralized finance (DeFi) and non-fungible tokens (NFTs) sectors.

Image source: Shutterstock

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Avalanche

Avalanche  Toncoin

Toncoin  Wrapped stETH

Wrapped stETH  Shiba Inu

Shiba Inu  Stellar

Stellar  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Chainlink

Chainlink  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Sui

Sui  Pepe

Pepe  LEO Token

LEO Token  NEAR Protocol

NEAR Protocol  Litecoin

Litecoin  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Aptos

Aptos  Internet Computer

Internet Computer  USDS

USDS  Hedera

Hedera  Cronos

Cronos  Ethereum Classic

Ethereum Classic  POL (ex-MATIC)

POL (ex-MATIC)  Ethena USDe

Ethena USDe  Render

Render  Bittensor

Bittensor  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Arbitrum

Arbitrum  Dai

Dai  WhiteBIT Coin

WhiteBIT Coin  Filecoin

Filecoin  Celestia

Celestia  MANTRA

MANTRA  Stacks

Stacks  OKB

OKB  Bonk

Bonk