The below is from a recent edition of the Deep Dive, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

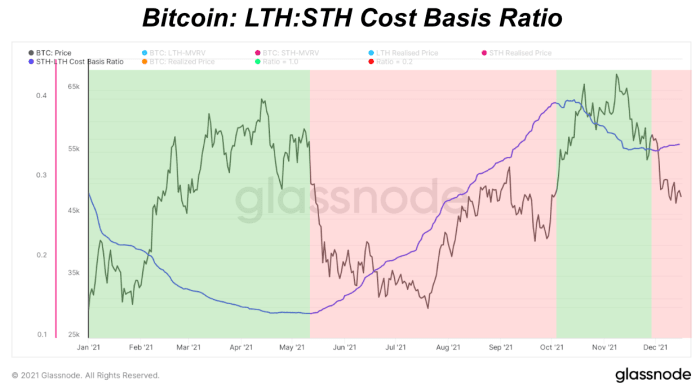

We have mentioned the cost basis ratio of bitcoin’s long-term holders (LTH) and short-term holders (STH) a numerous amount of times in our previous analysis.

For an introduction to the metric, read The Daily Dive #070 – Short-Term:Long-Term Cost Basis Ratio.

A TLDR:

When the STH:LTH realized price ratio is increasing, it means that the cost basis of STHs is increasing relative to LTHs, and conversely, when STH:LTH realized price ratio is decreasing, the cost basis of LTHs is increasing relative to the cost basis of STHs.

This is extremely insightful, as the price of bitcoin rises when the marginal seller is exhausted. This is why you see the cost basis of LTHs stay somewhat stagnant during explosive bull markets, while the cost basis of STHs (many of whom are new market participants) explode upwards — there are simply not enough coins to go around to meet newfound demand. Thus, “number go up.”

Looking at the metric recently, with price recently breaking below the cost basis of short-term holders, their cost basis is decreasing, and thus the metric is just barely increasing.

This is occuring as some recent market participants are capitulating and taking on-chain losses. A downtrend will resume once price has reclaimed the cost basis of short-term holders, ($52,495), or the aging in of coins into the long-term holder cohort causes their respective cost basis to increase against that of short-term holders.

Final Note

The secular trend of global bitcoin adoption will continue. Despite various macroeconomic uncertainties heading into 2021, there is never a bad time to increase your share of the world’s most sound monetary system. Consolidation to finish 2021 is the most likely scenario.

Sat stackers rejoice.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Avalanche

Avalanche  Stellar

Stellar  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  WETH

WETH  Sui

Sui  Pepe

Pepe  NEAR Protocol

NEAR Protocol  LEO Token

LEO Token  Litecoin

Litecoin  Aptos

Aptos  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Hedera

Hedera  Internet Computer

Internet Computer  USDS

USDS  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Ethereum Classic

Ethereum Classic  Render

Render  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Bittensor

Bittensor  Ethena USDe

Ethena USDe  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  Bonk

Bonk  Arbitrum

Arbitrum  Stacks

Stacks  Filecoin

Filecoin  OKB

OKB  Celestia

Celestia  Cosmos Hub

Cosmos Hub