The below is from a recent edition of the Deep Dive, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

Illiquid supply continues to hit multi-year highs, adding nearly 371,000 bitcoin since the deceleration in May. Even with the recent price drawdowns sparked from long liquidations and market sell-offs, illiquid supply continues to increase signaling that more long-term holders are adding bitcoin over the last few months.

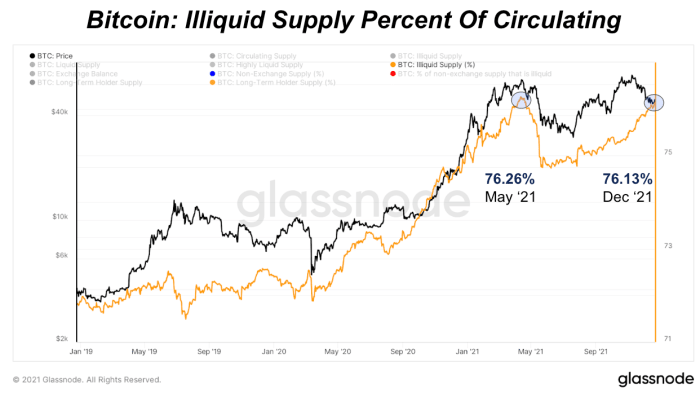

As a percentage of circulating supply, illiquid supply is 76.13% and just below the all-time high of 76.26% also seen back in May. Illiquid supply percentage of circulating supply has been a strongly correlated relationship with price over the last year.

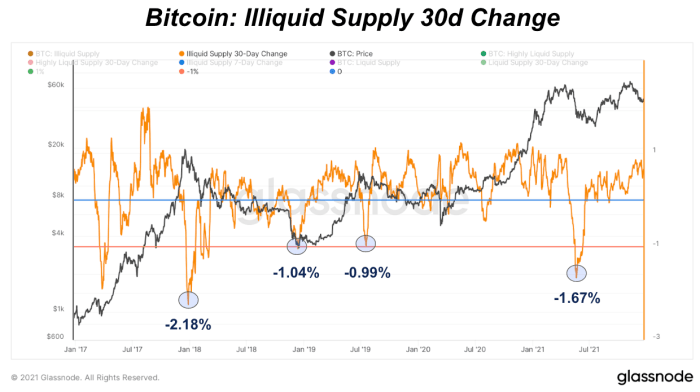

The illiquid supply trends also show that the most recent drawdowns were largely driven by the derivatives market and not so much the spot market. With every major bitcoin correction, there has been a significant deceleration in illiquid supply looking at the illiquid supply 30-day change. Typically this is a 30-day change in illiquid supply at or below -1%.

A 1% change of illiquid supply today would be 143,942 bitcoin worth just over $7 billion at a $49,000 price. We would expect a more significant, spot-driven bitcoin correction to come with a decelerating illiquid supply, which hasn’t been seen over the last few months.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Avalanche

Avalanche  TRON

TRON  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Stellar

Stellar  Polkadot

Polkadot  Chainlink

Chainlink  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Sui

Sui  NEAR Protocol

NEAR Protocol  Pepe

Pepe  LEO Token

LEO Token  Litecoin

Litecoin  Uniswap

Uniswap  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Internet Computer

Internet Computer  USDS

USDS  Hedera

Hedera  Cronos

Cronos  Ethereum Classic

Ethereum Classic  POL (ex-MATIC)

POL (ex-MATIC)  Bittensor

Bittensor  Ethena USDe

Ethena USDe  Render

Render  Arbitrum

Arbitrum  Celestia

Celestia  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  Filecoin

Filecoin  MANTRA

MANTRA  OKB

OKB  Bonk

Bonk  Stacks

Stacks