Cardano’s price has been on a downward trend since September, when its price peaked at $3.101. After entering a symmetrical triangle around mid-September, it went below the lower support line by mid-October to cement its extended downtrend. ADA briefly consolidated and even registered a couple of long green candles before reverting back to a downward spiral. By the time of writing, it remains on the same downward trajectory.

ADA/USD || Source: Trading View

ADA/USD || Source: Trading View

Increasingly, ADA has become more vulnerable to the broader market dynamics. It has joined the league of coins that are most influenced and swayed by Bitcoin’s price movements. ADA’s correlation with Bitcoin continues to inch up and now stands at almost one from zero not long ago. This means that Cardano is likely the trend set by the broader market led by Bitcoin.

How do the prospects look?

At the time of writing, the prospects for Cardano don’t look positive. The average HODLer balance, for example, has shrunk by more than half since October. This indicates the presence of macro sell pressure. The short-term prospects are no different either. In the last 12 hours, we have witnessed far more tokens sold than the ones bought by a variance of 8 million.

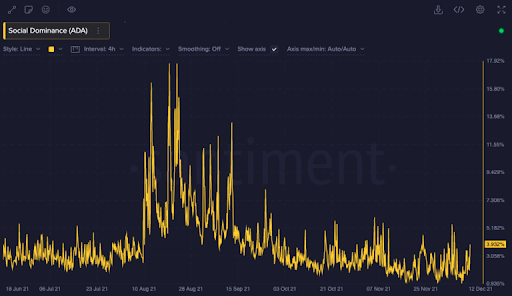

A sustained sell-side pressure means there is little hope for Cardano to tackle the bears. This is compounded by the coin’s weak social appeal at the moment. More often price peaks coincide with high social dominance for this alt. Social dominance is associated with increased mentions of the altcoin online on crypto-related social media.

Source: Santiment

Source: Santiment

Crowd euphoria coupled with a buy-side rally is the only way to negate the losses incurred thus far. Until that time, Cardano’s odds of recovering are low.

The post Cardano price bearish trend continues appeared first on Coin Journal.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Avalanche

Avalanche  Stellar

Stellar  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  WETH

WETH  Sui

Sui  Pepe

Pepe  NEAR Protocol

NEAR Protocol  LEO Token

LEO Token  Litecoin

Litecoin  Aptos

Aptos  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Hedera

Hedera  USDS

USDS  Internet Computer

Internet Computer  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Ethereum Classic

Ethereum Classic  Render

Render  Ethena USDe

Ethena USDe  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Bittensor

Bittensor  Bonk

Bonk  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  Celestia

Celestia  Arbitrum

Arbitrum  MANTRA

MANTRA  Filecoin

Filecoin  Cosmos Hub

Cosmos Hub  OKB

OKB