2021 witnessed the emergence of various digital assets. From scalability protocols such as MATIC, to meme coin extraordinaire Shiba Inu. While these assets grew multi-fold, a recent survey highlighted the rising importance of continued growth of Bitcoin adoption.

The survey indicates several key differences between 2020 and 2021’s growth curves in crypto. One of the key factors is the store-of-value narrative during an inflation-riddled period. A majority of investors also considered BTC as an investment rather than a currency.

55% of Bitcoin investors started in 2021

Grayscale carried out an online survey with 1,000 U.S consumers aged between 25 to 64. These individuals had primary or shared responsibility for financial decisions. The responders involved had at least $10,000 invested assets, and another $50,000 in household income.

After analysis, it was determined that investors are more approving of Bitcoin in 2021 than in 2020. 26% of the investors were Bitcoin holders already and from that group, 46% and 44% jointly invested in Ethereum and Dogecoin.

In addition to that, more than 59% of these investors used cryptocurrency trading applications, shifting from a massive 77% inclination towards exchanges in 2020. Similarly, more than 66% of those who bought BTC more than 12 months ago are still holding, inferring a higher long-term sentiment with the digital asset. With more than 91% of the investors still in profit, it is not surprising that BTC still accounts for 46% of the total value of crypto markets.

Moreover, investors believed that a Bitcoin ETF should be the way to go forward. While a Bitcoin futures ETF received approval in October 2021, surveyors would prefer a spot BTC ETF backed by Bitcoin and not futures.

Investment vs Currency?

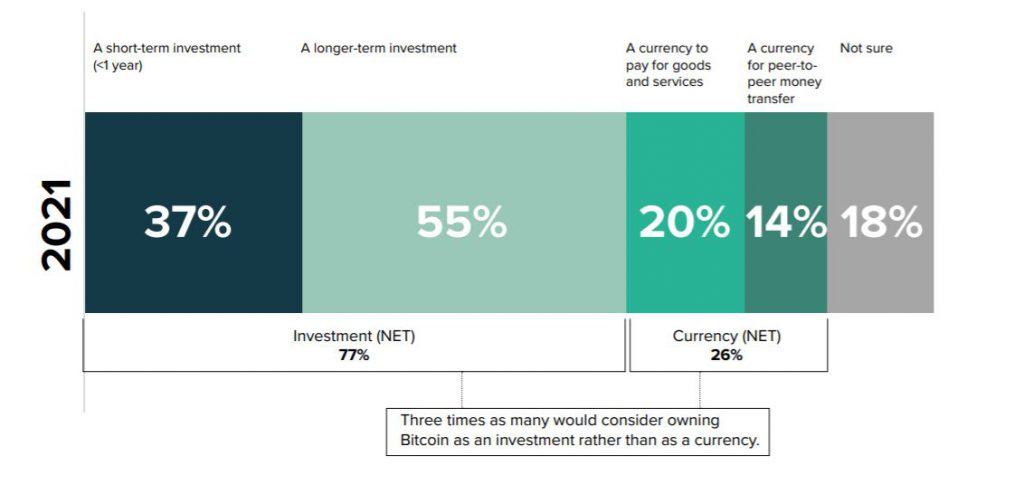

The crypto industry is no longer a wild-west ecosystem. The understanding towards Bitcoin and other assets has evolved but the direction is still developing. While most BTC proponents like to elevate its credentials as a currency, most of the respondents considered it as an investment over the medium of exchange.

El Salvador might have legalized Bitcoin as a legal tender but according to the survey three times as many investors owned BTC from a store-of-value narrative. In a detailed breakdown, 37% believed its a short-term investment. While 14% looked at it from a money transfer method.

Overall, the landscape remained quietly evident. Bitcoin’s adoption curve continues to outperform other assets where it matters. While its price may not reflect astronomical surges, it’s institutional and retail capital flow remains consistent.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Toncoin

Toncoin  Stellar

Stellar  Sui

Sui  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  WETH

WETH  Polkadot

Polkadot  Pepe

Pepe  LEO Token

LEO Token  NEAR Protocol

NEAR Protocol  Litecoin

Litecoin  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Hedera

Hedera  USDS

USDS  Cronos

Cronos  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  POL (ex-MATIC)

POL (ex-MATIC)  Ethena USDe

Ethena USDe  Render

Render  Bonk

Bonk  Bittensor

Bittensor  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  MANTRA

MANTRA  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Arbitrum

Arbitrum  dogwifhat

dogwifhat  Monero

Monero  Stacks

Stacks  Filecoin

Filecoin  Cosmos Hub

Cosmos Hub