The below is from a recent edition of the Deep Dive, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

Yesterday, the Federal Reserve Board announced doubling the pace of its asset tapering to $30 billion a month, which was slightly more hawkish than consensus expectations. Rather than end all asset purchasing today, Jerome Powell highlighted that a calculated, methodical approach to winding down asset purchasing is a more stable approach for markets. The current plan is for asset purchases to end by March 2021 with the market expecting a high probability of three interest rate hikes in 2022, up to 100 basis points.

On cryptocurrencies, Powell commented that he doesn’t see them as a major financial stability concern, but that the leverage in the system is worth watching. He noted they are risky and speculative while highlighting the potential benefits of stablecoins if they were to be regulated.

All that said, Powell had a tremendous amount of dovish commentary in his Q&A despite the more hawkish actions, indicating the Federal Reserve is ready to pivot their policy as necessary with more accommodative monetary policy. This was a favorable short-term signal to markets. We’ll see real monetary tightening policy start to play out in markets if rate hikes happen in March.

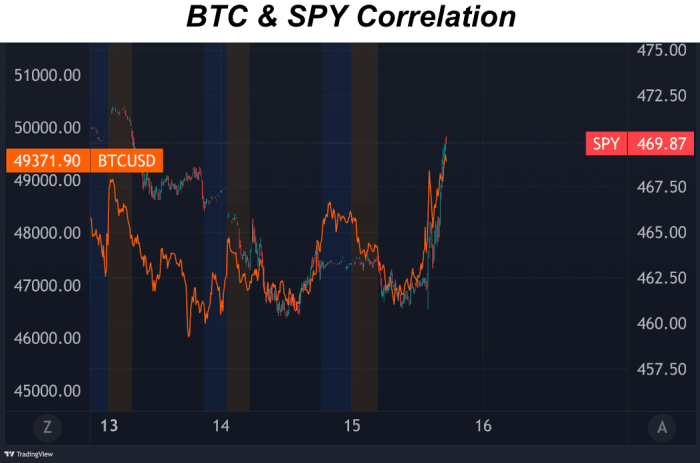

Following the announcements of the Fed’s expected taper policy, both bitcoin and equities rallied in tandem, indicating the meeting was a sell the rumor and buy the news type of event.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Avalanche

Avalanche  Toncoin

Toncoin  Stellar

Stellar  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  WETH

WETH  Sui

Sui  NEAR Protocol

NEAR Protocol  Pepe

Pepe  LEO Token

LEO Token  Litecoin

Litecoin  Aptos

Aptos  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Internet Computer

Internet Computer  Hedera

Hedera  USDS

USDS  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Ethereum Classic

Ethereum Classic  Render

Render  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Bittensor

Bittensor  Ethena USDe

Ethena USDe  WhiteBIT Coin

WhiteBIT Coin  Stacks

Stacks  Bonk

Bonk  Dai

Dai  Arbitrum

Arbitrum  Filecoin

Filecoin  Cosmos Hub

Cosmos Hub  OKB

OKB  MANTRA

MANTRA