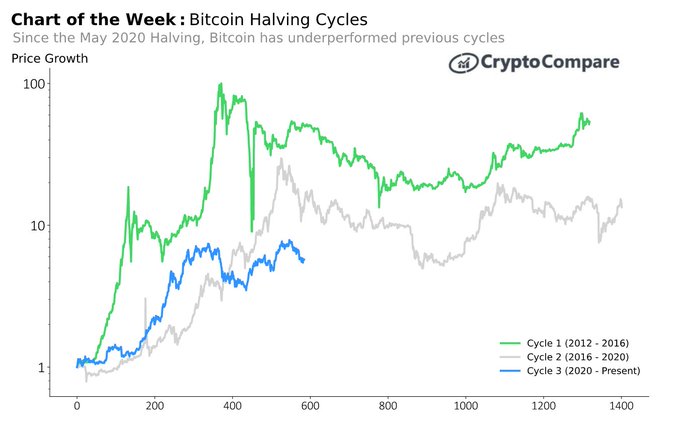

With Bitcoin’s current return of approximately 456% since the third halving event in May 2020, this is a significant underachievement compared to the two previous cycles of 2012 and 2016, which had recorded 1,355% and 4,974% respectively at this point in time.

Market insight provider CryptoCompare confirmed:

“BTC returns from this cycle underperform the two previous cycles which returned 4,974% and 1,355% respectively at this point in time. This fuels the fear that the 4yr cycle that many market participants believe in is no longer an appropriate narrative.”

Nevertheless, Bitcoin’s present return is higher than traditional asset classes like S&P 500 with 59.3%.

Bitcoin halving refers to the reduction of Bitcoin block rewards, which occurs once every 210,000 blocks are created, and it usually happens around every four years. Block reward refers to the amount of Bitcoin received by miners after they successfully validate a new block. The rationale behind this is Bitcoin’s design, whose total supply is capped at 21 million coins.

Bitcoin’s third halving took place on May 11, effectively reducing the block rewards from 12.5 to 6.25 BTC per new block. This was the third time in its history that this event was happening as the previous ones occurred in 2012 and 2016. Precisely, Bitcoin’s block rewards went down to 25 from 50 Bitcoin per block in November 2012. It further decreased to 12.5 units in July 2016.

The logic behind halving events is that more BTC gets mined as more people utilize the Bitcoin network. Therefore, by slashing the mining rewards by half, retrieving this digital asset becomes difficult, increasing its value based on limited supply.

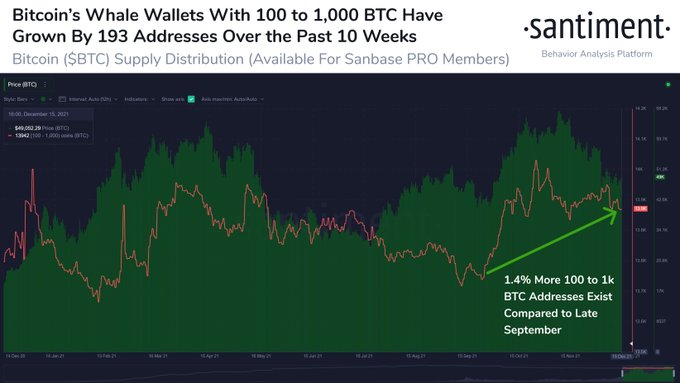

Meanwhile, the number of Bitcoin whales continues to grow.

“The number of whale addresses holding 100 to 1,000 BTC has 193 more addresses in this prestigious club, compared to just 10 weeks ago. The number of whales in this tier has shown some strikingly impressive parallels to BTC price, historically,” according to crypto analytic firm Santiment.

Image source: Shutterstock

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Avalanche

Avalanche  Toncoin

Toncoin  Stellar

Stellar  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Chainlink

Chainlink  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Sui

Sui  Pepe

Pepe  NEAR Protocol

NEAR Protocol  LEO Token

LEO Token  Litecoin

Litecoin  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Aptos

Aptos  Internet Computer

Internet Computer  USDS

USDS  Hedera

Hedera  Cronos

Cronos  Ethereum Classic

Ethereum Classic  POL (ex-MATIC)

POL (ex-MATIC)  Render

Render  Ethena USDe

Ethena USDe  Bittensor

Bittensor  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Arbitrum

Arbitrum  Dai

Dai  Celestia

Celestia  WhiteBIT Coin

WhiteBIT Coin  Filecoin

Filecoin  Bonk

Bonk  Stacks

Stacks  OKB

OKB  dogwifhat

dogwifhat