On the surface, Bitcoin seems poised to take over as the world reserve currency based on the game theory of people converging on the adoption of a single hard and sound currency.

The original cryptocurrency has officially entered into its teenage years following the publication of the white paper on October 31, 2008. Plebs have been stacking bitcoin since the genesis block was mined on January 3, 2009. Both private and public companies have been accumulating it, and even governments have taken the plunge. Looking at the macro picture is certainly exciting from the standpoint of an early adopter.

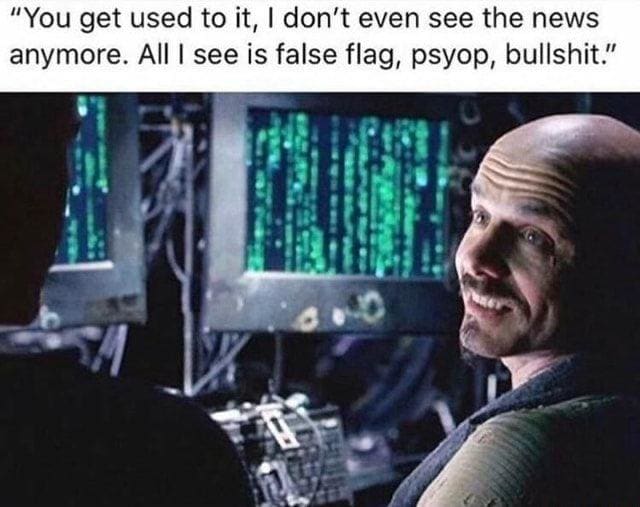

Every ten minutes, blocks are being added to this decentralized timechain and Bitcoin is working as designed. The task at hand is for Bitcoiners to stay vigilant in order to keep it that way. One strategy for this is to constantly be thinking of attack vectors in all of their forms. To that end, this piece focuses on possible social and governmental sabotage.

El Salvador And Bitcoin Vs. The Globalists

On November 20, 2021, Nayib Bukele, the president of El Salvador, announced plans to create a “Bitcoin City,” funded by bitcoin-backed bonds.

The city would charge 0% income, capital gains, property, payroll and municipal taxes. The only tax levied will be a value-added tax. In addition to all of those 0% taxes, the city plans to have 0% carbon emissions by utilizing the geothermal energy from the nearby Conchagua volcano.

The country is funding this centrally-planned project through bitcoin-backed “Volcano Bonds” spearheaded by Blockstream. Bukele has been praised by the Bitcoin community for adopting bitcoin as legal tender in El Salvador. He has welcomed Bitcoiners with open arms, offering citizenship to people who invest 3 bitcoin in the country and even changed the travel requirements to exclude proof of vaccination and negative COVID-19 test results, which coincidentally went into effect on the same day that the Adopting Bitcoin conference started.

Bukele’s term has not been without criticism. In May, he ousted five Supreme Court justices and the attorney general, purportedly because they ruled that his COVID-19 stay-at-home order was unconstitutional.

In September, Bukele passed laws removing judges who were over 60 years old, effectively firing approximately 30% of the sitting judges. A few days later, Bukele’s courts ruled that presidents could run for consecutive terms, defying El Salvador’s constitution and setting Bukele up for an additional term.

Following this, the National Assembly passed a law allowing for land and estate expropriations (read: seizure) in the name of an ambiguously defined “public interest.” There’s more questionable behavior from Bukele and his cronies, but the theme here is a strong trend of nationalization and squashing opposition that is reminiscent of other authoritarian regimes.

These are not qualities that Bitcoiners laud and we should be wary of this type of statist conduct. Adopting Bitcoin does not preclude governments from being totalitarian empires and we should be aware of the cognitive dissonance that comes with praising a country for adopting a free and open monetary network while also ignoring its obvious tyrannical tendencies.

The announcement of “Bitcoin City” was met with excitement by Bitcoin news outlets and many people on Bitcoin Twitter, though there are some who feel skeptical of this plan, myself included.

I think it’s possible and even likely that Bukele truly “gets it” and wants Bitcoin to succeed. I also find it curious that his strategy to make bitcoin legal tender and facilitate positive tax policy for bitcoin investors in the country is being largely ignored/allowed by the Bank of International Settlements (BIS), the International Monetary Fund (IMF) and the World Bank.

Bukele was also recently announced as a speaker at Bitcoin 2022 in Miami, FL. I am especially suspicious because he will be in attendance for the speech in the very country whose power he is directly usurping by abandoning the dollar standard. Notably, the United States has been extremely quiet about El Salvador’s adoption of Bitcoin.

So, what is going on here? Are these world organizations largely ignoring this radical move because El Salvador is deemed too inconsequential of a nation? An executive at the BIS said El Salvador’s adoption of bitcoin as legal tender is an “interesting experiment,” the World Bank denied El Salvador’s request for help adopting bitcoin as legal tender, and now that the country did it regardless, the IMF has issued a gently-worded statement advising against the country using bitcoin as legal tender due to its volatility. Most recently, the chief at the Bank of England called El Salvador’s move to adopt Bitcoin as its currency concerning.

Why are these major globalist organizations being so light-handed in their responses to this overtly subversive move? And who will be the first Bitcoiners to move to Bitcoin City at the base of a volcano?

Where Are The “Economic Hit Men”?

I admit that my worldview is biased toward expecting the United States government to handle this with some sort of renegade, extrajudicial “accident” à la the Bay of Pigs, Gulf of Tonkin, Mossadeq coup, numerous assassinations in Africa, etc. Why are the three-letter agencies in the United States ignoring El Salvador and their adoption of bitcoin as legal tender?

In “Confessions Of An Economic Hit Man,” John Perkins writes about the presidents of Ecuador and Panama, Roldós and Torrijos, respectively, who were assassinated by the CIA for not getting in line with global imperialism.

The book details numerous examples, such as those in which agents of the corporatocracy went into developing countries, projected unrealistic electrical infrastructure growth and sold the locals the necessary facilities to achieve it, putting them in massive debt to the United States so that the countries would be forever subservient to the interests of Washington and Wall Street.

This originated with the Monroe Doctrine, which took manifest destiny a step further in the 1850s by using it to claim that the U.S. had special rights all over the hemisphere, including the right to invade any nation in Central or South America that refused to back U.S. policies. Later, this was invoked to justify intervention in the Dominican Republic, in Venezuela and in Panama in order to develop the Panama Canal. The leaders who had the foresight to see this economic subjugation for what it was and chose not to comply often had coincidental accidents and were replaced by authoritarian dictators.

In his book, Perkins details how the Panama Canal was completed after a coup orchestrated by Theodore Roosevelt, whose troops killed a local militia commander and declared Panama an independent nation where a puppet government was installed and the first Panama Canal Treaty was signed, without Panamanian influence or support.

Panama was then ruled by oligarchic families with ties to Washington and who allied with United States’ interests by supporting the CIA, NSA, big businesses, and anti-communist factions. The result was an opulent, U.S.-controlled Canal zone surrounded by destitute Panamanian slums. The folk hero and politician, Omar Torrijos, negotiated a deal with the Carter administration to repatriate the Panama Canal. This angered the Reagan-Bush administration so much that it sought to assassinate him. Torrijos died in a plane crash during a routine flight which most of the world outside of the United States viewed as a CIA assassination.

This is only one example of United States government intervention in world affairs from the book. Perkins explains how the Great Depression resulted in the New Deal, which further advanced economic regulation and governmental financial manipulation in the country, directly led to the creation of the World Bank, the IMF and the General Agreement on Tariffs and Trade after WWII.

A focus of this time period was the promotion of Robert McNamara. This Keynesian advocate rose in the ranks at Ford Motor Company to become the company’s president. He was then appointed secretary of defense and later president of the World Bank. McNamara was one of the primary, early examples of the military-industrial complex, having served as the head of a major corporation, a government cabinet and the most powerful bank in the world. This is a clear example of the blurred lines of corporate and government interests which continues to this day, with members of Congress owning significant amounts of Pfizer and Johnson & Johnson stock while pushing for mandatory vaccination.

Is the world’s ostensible acceptance of El Salvador opting into bitcoin as legal tender due to negligence, or is there something else going on?

Paranoiac, Adversarial Thinking

One possibility is that El Salvador and its adoption of bitcoin as legal tender is being ignored by central banks around the world and the U.S. alphabet soup agencies because the time of American Imperialism is coming to an end due to insolvency and the implosion of dollar hegemony.

Or maybe there is a larger play at work to bring about the Great Reset using bitcoin as a backstop. This is a highly improbable possibility, but a possibility nonetheless.

On a recent “Tales From The Crypt “episode, Matt Hill of Start9 spoke with host Marty Bent about the ingenuity of governments making Bitcoin regulations increasingly cumbersome for those interacting with on/off ramps through institutional systems, but without making Bitcoin outright illegal. His point was bringing attention to the effectiveness of wearing people down by making a certain behavior inconvenient.

Hill said, “The internet, as is, and the server/client architecture, as is, is not conducive to a viable future for Bitcoin. Bitcoin cannot live on a centralized internet. Not as ‘Bitcoin,’ anyway. If there’s one node, running on one server, controlled by one entity, it’s not really Bitcoin anymore.”

Bent then mentioned the censorship-resistant assurances that Bitcoin provides when it’s running in a distributed way and Hill went on to say that consensus rules can be changed more easily (when centralized) and compared Bitcoin to a surveillance tool if it’s running on a centralized server.

“Bitcoin in the hands of a few people on a few servers, which again, it’s not going to happen, but it is sort of a statist’s wet dream… It’s a giant, public, open ledger of every transaction on Earth, but if you can just pin identities to those things it’s perfect,” Hill said.

This type of thinking is extremely necessary for us to examine when we think about possible attack vectors for Bitcoin.

Catherine Austin Fitts, former assistant secretary of housing and federal housing commissioner at the U.S. Department of Housing and Urban Development in the first Bush Administration, is an outspoken critic of COVID-19 lockdowns, vaccine passports, central bank digital currencies (CBDCs), and the Great Reset in general.

Recently, videos have been circulating of her speaking about central bankers, “exercising a coup d’état where they are taking control of fiscal policy [from the electorate] as well [as monetary policy]. With the advances of digital technology, vaccine passports will not be about health. Vaccine passports are part of a financial transaction control grid that will absolutely end human liberty in the West.”

This hypothesis is not new to those on Bitcoin Twitter nor to many of the people who believe in the freedom and financial sovereignty that Bitcoin provides.

In an interview with Greg Hunter, Austin Fitts said, “We are in Never, Never Land. We have two groups in our society: One group that can print money, and the other who can earn money. What we saw last year is the people who could print money declared war on the people who earn money. They basically said we are going to shut down your businesses, and we are going to suck up and take your market share or buy you out with money we print out of thin air… There is no pandemic. What this is is an economic war.”

She recommended getting corrupt institutions out of your life, including keeping money with Federal Reserve-related banks, but surprisingly, she also said in an interview with Daniel Liszt that, “You can’t solve a political problem with a financial product.”

This is irreconcilable with what many Bitcoiners believe because, as they say, “fix the money, fix the world.”

Austin Fitts has been wary of Bitcoin for many years and spoke publicly against it as early as January 2014. In her interviews, she makes some relevant points that Bitcoiners should take into consideration, though oftentimes, she clearly misunderstands how Bitcoin works on a fundamental level. I won’t get into everything she has said about Bitcoin that is factually inaccurate, but she believes that the government could take the bitcoin price down to zero or shut it down in the same way that social media companies are shutting down people’s accounts. She also has equated the seizure of assets from Silk Road as proof that the system is insecure. While the aforementioned points have been disproven through other examples, like police being unable to access “seized” bitcoin and Marathon Digital Holdings announcing it would no longer be censoring transactions (with reasons not specified), Austin Fitts does share some important points from her interview with Greg Hunter that Bitcoiners should focus on, especially considering that the digital currency is entering the world stage:

1. “The easiest way to build the prison is to get freedom lovers everywhere building it for you.”

CBDCs will most likely be modeled after bitcoin, though the goal will be complete control of individuals spending habits with unsanctioned purchases being disabled and/or leading to a negative impact on a social credit scoring system, like the one China is currently using.

Austin Fitts thinks that governments around the world are letting Bitcoin developers build out a system, but will then usurp its functions for their own globalist agenda. She has mentioned “The Master Switch” by Tim Wu, who details that, when new technology arises, there’s a period of innovation and then it centralizes because it’s cheaper and easier that way.

As Bitcoin users, we need to continue staying vigilant (read: toxic) about protecting the Bitcoin network from malicious actors by keeping the network decentralized. This means running a Bitcoin full node. It’s not too expensive to run a node, but it’s extremely important. “Not your node, not your rules,” as the saying goes.

In her most recent video release, Austin Fitts declared some steps to decentralize the money.

“We have to figure out how to take back control of the money system,” she said. “The important thing about any money or financial system comes down to the quality of governance. The reason the current financial systems are so powerful is because their governance is backed up by awesome force. We won’t have awesome force to back up ours. We need excellence in governance, a commitment to rule of law, and a culture because there’s not enough enforcement in the world to backup a great culture. That enforcement has to come not just from law, but from culture.”

She went on to say, “That system is going to have to be both physical and digital. We need the digital for efficiency, but we need the physical to keep it honest and real.”

To be frank, it sounds like she’s talking about Bitcoin: digital value transferred using hardware nodes and miners which use physical electricity.

2. “Invest your money into things that will build resiliency for yourself and your family. Are you spending all your money on bitcoin and not supporting your local farmers?”

In an August interview with Whitney Webb, Austin Fitts shared some recommendations for surviving the coming instability. Her biggest reminder is to be resilient. Following resiliency, her suggestions include securing ways to source healthy food and finding water independence through drilling a well.

She also suggested using jurisdictional arbitrage to move where the cost of living is low to avoid inflation as much as possible. Moving further from cities increases the chances that the people around you know how to do things for themselves.

Bitcoin citadels are frequently discussed as a means of creating sovereign communities. Food security through local economies is best cultivated through farmers’ markets and direct support through community supported agriculture (CSA). All of this advice involves building “living” equity. As Fitts said, “If you are putting all your money into Bitcoin and you have no farmland, no cattle, and no farmer, you may be wealthy on Bitcoin, but you’re going to have to eat synthetic meat from Bill Gates.”

3. “How many hours are you spending on Bitcoin? Could that time be used supporting your family or otherwise being put to work?”

There are thousands of hours of phenomenal podcasts about Bitcoin, countless Bitcoin books and articles to read, and tons of video interviews and documentaries to watch — let alone the time it takes to figure out how to use Bitcoin, connect your wallet to your node, and create multisignature quorums. These are all incredibly important pratices, but so are other universal abilities. If you invest in developing your skills, they can go with you if you need to move: growing food, building, coding, canning, wilderness survival, plant/fungus identification, first aid, sewing, etc. These are all things that can be used in many different contexts.

In conclusion, as Bitcoiners, we need to remain skeptical of everything, and I mean everything. Stay vigilant and use adversarial thinking in order to avoid becoming complacent so that we can protect the monetary sovereignty that the Bitcoin network provides.

G. Michael Hopf said, “Hard times create strong men. Strong men create good times. Good times create weak men. Weak men create hard times.” It seems clear that we are in a period of hard times right now. We need to make sure that as we develop into the strong men (and women) that will create good times in the future, we can continue them for as long as possible.

As Austin Fitts suggested as she ended her speech, “Don’t ask if there’s a conspiracy, if you’re not in a conspiracy, you need to start one.”

Take everything you read, hear, and see with a hint of suspicion, including this article.

Shared without comment, source

This is a guest post by Craig Deutsch. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Avalanche

Avalanche  Stellar

Stellar  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  WETH

WETH  Sui

Sui  Pepe

Pepe  NEAR Protocol

NEAR Protocol  LEO Token

LEO Token  Litecoin

Litecoin  Aptos

Aptos  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Hedera

Hedera  Internet Computer

Internet Computer  USDS

USDS  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Ethereum Classic

Ethereum Classic  Render

Render  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Ethena USDe

Ethena USDe  Bittensor

Bittensor  Bonk

Bonk  WhiteBIT Coin

WhiteBIT Coin  Arbitrum

Arbitrum  Dai

Dai  Filecoin

Filecoin  Cosmos Hub

Cosmos Hub  Celestia

Celestia  MANTRA

MANTRA  OKB

OKB